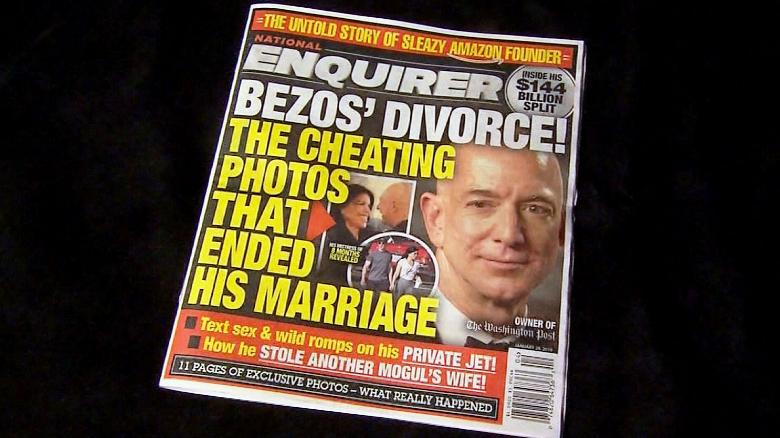

Forbes richest big cheese, Jeff Bezos, recently divorced his wife of 25 years in what could be the most costly divorce settlement of our time.

And prominent short seller Doug Kass, a self-proclaimed anti-Cramer and CNBC reject, made a controversial sell off of Amazon right after the news.

I suspect his move is just one of many that could affect you as an investor (and as an online shopper).

Afterall, a divorce often destabilizes a person’s image. Jeff Bezo’s lewd pictures with Lauren Sanchez don’t help either. And Bezo’s said, in response to Sears bankruptcy:

“Amazon is going to fail. Amazon will go bankrupt.” He continued, “if you look at large companies, their lifespans tend to be 30-plus years, not a hundred-plus years.”

It’s hard to tell what will finally cause Amazon to fall, including the tough break we had in 2018 when even Bezos lost a record $19.2 billion dollars in 2 days.

But a company, founded by a billionaire ex-hockey player, has investors on the edge of their seats.

His company – previously ignored by Wall Street bigwigs – is starting to attract attention. It could be potentially bigger than Amazon. And according to Forbes magazine his new newest venture looks exactly like…

“A Baby Berkshire Hathaway”

As you may know, Berkshire Hathaway is Warren Buffett’s famous holding company. The real reason most investors know Berkshire Hathaway is because a single share of Berkshire Hathaway trades for over $300,000! But it wasn’t always like that. Back in 1967 you could have picked up shares of Berkshire Hathaway for about $12. Many that did are now multi-millionaires.

So you can see why a $4 stock that follows the same “Buffett Blueprint” is starting to garner widespread attention.

This free presentation reveals why this little-known $4 stock could fund your retirement.

And you’ll discover why buying this stock today could be like picking up shares of Berkshire Hathaway back in 1967. Click here to view this eye-opening presentation before it goes offline.

You May Like