One of the single most important tenets to successful investing is mastering the principle of proper asset allocation.

One of the single most important tenets to successful investing is mastering the principle of proper asset allocation.

When set up correctly, the proper asset allocation for YOU can protect you from unnecessary risk while still giving you the opportunity to go after impressive returns. You won’t hear asset allocation talked about much by the Wall Street hot shots. They’d rather focus on the latest IPO or the next crash scare.

But over the long haul, proper asset allocation can do more for your account balance than attempting to pick the hot stock of the month.

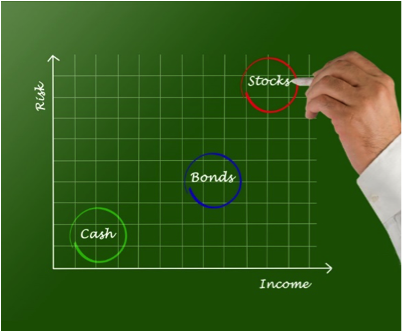

Asset allocation involves spreading an investment portfolio among the different types of asset categories. Some of the more common categories of assets would include stocks, bonds as well as cash. Within each of these categories, an investor would allocate a certain percentage of their portfolio capital. Depending upon the amount of risk one is willing to take, you would put more or less money into each asset class.

Typically, investors who have more time and can handle more risk are going to put more capital into investments like stocks. Stocks will tend to give a larger return over time but come with the potential for having a larger risk associate with them. If an investor has a long-time horizon, they may be able to handle having periods of draw down where the stock market may be selling of a bit.

Investors who have less time may not want to have as much risk will tend to place their capital in to things that are less risky like bonds and cash. While these don’t earn as high of a return, they do offer the safety of funds that some investors need.

Because of the limited time, they want to make sure their funds remain in a relatively safe place.

Overall, as investors look at what the best allocation of their funds will be, they will need to consider many factors, including time and level of risk they want to take. The concept of high risk and high return or low risk and low return hold true with how we end up allocating our funds.

As a rule of thumb, take the following into consideration when deciding how you should allocate your funds.

How much time do you have before you need the money.

1. Your ability to earn income.

2. How liquid you will need your money – will you need to get it quickly.

While there are many different choices in how much to allocate to each asset class, the important thing to understand is to make it work for you. As part of your on-going subscription to the Premium Income Letter, you’ll receive access to the Buy & Bank Portfolio.

How you view yourself as an investor will ultimately determine what asset allocation mix is right for you. So take a minute right now and decide which of the three classifications below describes you. Later in this issue you’ll see the details of the Buy & Bank model portfolio. – T.G.

Conservative Investors: Investors here are more concerned with making sure their investments don’t shrink in value. They want to maintain the wealth they have and make enough profit to stay ahead of inflation. Their tolerance for risk is low. Think of this group as retirees – looking to maintain their standard of living throughout their golden years.

Moderate Investors: Investors in this group want to outperform the market – and inflation – by a significant margin. And they’re willing to take on more risk to accomplish this. Think of these investors as Millenials, or people with decades ahead of them to build wealth who don’t want to be reckless, but want to stay ahead of the average investor.

Aggressive Investors: These investors are willing to take on a lot more risk, in return oversized gains. Think of this group as people of all ages including people closing in on retirement, who realize their savings won’t cut it, or retirees who’ve suffered a loss in the markets or other financial hardship. They’re on a mission to regain wealth fast and will take on risk to do so.